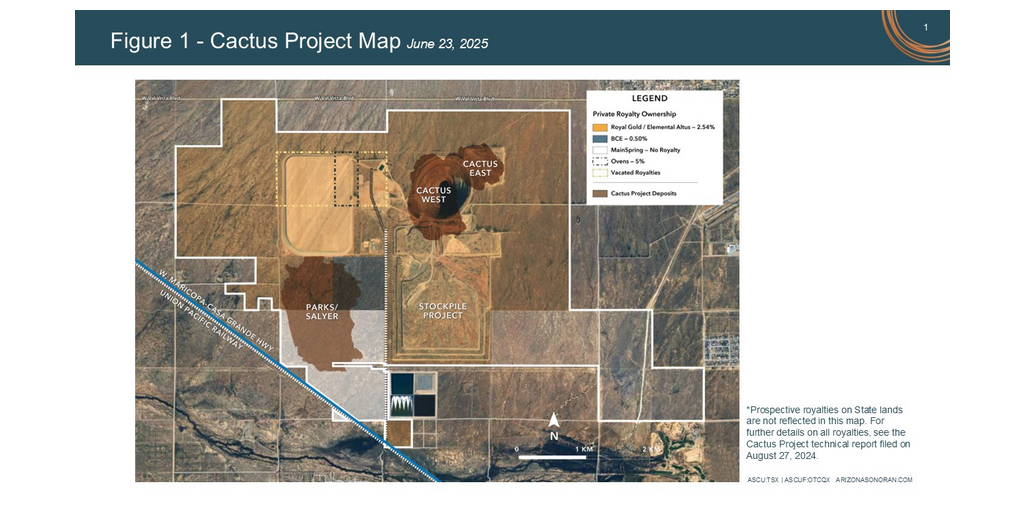

CASA GRANDE, Ariz. & TORONTO--(BUSINESS WIRE)--$ASCU #Arizona--Arizona Sonoran Copper Company Inc. (TSX:ASCU | OTCQX:ASCUF) (“ASCU” or the “Company”), an emerging U.S. copper developer, is pleased to announce that its subsidiaries have exercised their rights to buy-down 0.64% of certain net smelter returns royalties on the Cactus Project (collectively, the “NSRs”; see FIGURE 1, outlined in yellow), ahead of the applicable July 10, 2025 exercise notice expiry dates. Total cash payments of US$8.91 million will be made to RG Royalties LLC, a subsidiary of Royal Gold Inc. (RLGD:NASDAQ) and Elemental Altus Royalties Corp. (ELE:TSXV), to reduce the aggregate percentage of the NSRs from 3.18% to a remaining 2.54% (collectively, the “Buy-downs”). The Buy-downs are expected to close on or about August 12th, 2025.

The Buy-downs continue the Company’s royalty reduction strategy as it continues to optimize Project economics in advance of the Pre-Feasibility Study (“PFS”) scheduled for completion later this year. The remaining 2.54% NSR applies to the Cactus West and Cactus East deposits as well as a portion of the Parks/Salyer deposit, outlined in yellow in FIGURE 1. In early Q2 2025, the Company's subsidiary had two historic ASARCO royalties (Nolles/Wagoner; each 5%) vacated by final judicial order. Additionally, in January, ASCU bought down a royalty on the BCE Property, covering a small portion of the Parks/Salyer deposit, from 1.5% to 0.5% for a cash payment of US$500,000 (PR dated JAN 6, 2025), as outlined in blue in FIGURE 1. The southern portion of the Parks/Salyer deposit outlined in white in FIGURE 1, formerly referred to as the MainSpring Property, is not subject to any royalties and comprises the first four years of production in a conceptual mine plan as contemplated by the 2024 Preliminary Economic Assessment (“2024 PEA”; see PR dated AUG 4, 2024 | Technical Report).

George Ogilvie, ASCU President, CEO and Director commented, “Upon completion of these Buy-downs, the collective reduction of Cactus Project royalties in 2025 will be a strategic milestone for the Company, set to strengthen Project economics, optimize future cash flows and return copper price upside to our shareholders, as projected in the 2024 PEA. Having just completed the $51.75 million bought deal financing, we now have the necessary runway to advance Cactus, with confidence and clarity, through PFS) and then Definitive Feasibility Study to an eventual Final Investment Decision, potentially in Q4 2026. Our team remains focused on the critical workstreams needed to position the Cactus Project as a lower risk, top-tier copper development project and among the best-positioned in North America to deliver copper cathode production, with a projected industry-leading capital intensity.”

The Company’s subsidiaries, Cactus 110 LLC and Arizona Sonoran Copper Company USA, Inc., have provided notice of exercise of their rights to buy‑down (i) Royal Gold’s 2.5% NSR to 2.0% for US$7.0 million and (ii) Elemental Altus’ 0.68% NSR to 0.54% for US$1.91 million, that will result in an aggregate reduction in Cactus Project royalties of 0.64% for aggregate payments of US$8.91 million. These NSRs were initially purchased in 2021 by funds of Tembo Capital and Resource Capital Funds, which each subsequently sold its NSRs to Royal Gold (December 2024) and Elemental Altus (September 2023), respectively. The Buy-downs are expected to close on or about August 12, 2025, following which Royal Gold will hold a 2.0% NSR and Elemental Altus a 0.54% on the Cactus Project (as shown in FIGURE 1, outlined in yellow).

About the Cactus Project

The Project is a lower risk brownfield open pit copper project with onsite permitted water wells, substation and transmission lines, neighbouring nationwide railroad, nearby nationwide highway and an on-site office with a team of 20 engineers and geologists advancing Cactus to PFS, scheduled for completion later this year. The PFS will build off the heap leach and solvent extraction and electrowinning operation, producing LME Grade A copper cathodes, as contemplated in the 2024 PEA. The 2024 PEA projected a low capital intensity of under $10,000 per ton and an unlevered life of mine free cash flow of approximately $7.3 billion, from annual average production of 116,000 short tons of copper cathode over the first 20 years. The 2024 PEA projected an after-tax net present value (8%) of $2.03 billion and internal rate of return of 24%, at a $3.90/lb copper price, and an increase to $2.9 billion and 30%, respectively, at a copper price of $4.50/lb. ASCU has appointed Hannam & Partners as project financial debt advisor for project financing. Upon completion of the PFS, the Cactus Project team will immediately advance required amendments of applicable state permits and initiate the Definitive Feasibility Study for completion ahead of a potential Final Investment Decision, potentially by Q4 2026.

Neither the TSX nor the regulating authority has approved or disproved the information contained in this press release.

Links from the PR:

FIGURE 1: https://arizonasonoran.com/projects/cactus-mine-project/press-release-images/

Aug 7, 2024 Press Release: https://arizonasonoran.com/news-releases/arizona-sonoran-standalone-pea-for-cactus-open-pit-project-reports-post-tax-npv8-of-us-2.03-billion-c-2.77-billion-and-irr-of/

Technical Report: https://arizonasonoran.com/projects/technical-reports/

Jan 6, 2025 Press Release: https://arizonasonoran.com/news-releases/arizona-sonoran-buys-back-1.0-of-the-bronco-creek-exploration-royalty/

About Arizona Sonoran Copper Company (www.arizonasonoran.com | www.cactusmine.com)

ASCU is a copper exploration and development company with a 100% interest in the brownfield Cactus Project. The Project, on privately held land, contains a large-scale porphyry copper resource and a recent 2024 PEA proposes a generational open pit copper mine with robust economic returns. Cactus is a lower risk copper developer benefitting from a State-led permitting process, in place infrastructure, highways and rail lines at its doorstep and onsite permitted water access. The Company’s objective is to develop Cactus and become a mid-tier copper producer with low operating costs, that could generate robust returns and provide a long-term sustainable and responsible operation for the community, investors and all stakeholders. The Company is led by an executive management team and Board which have a long-standing track record of successful project delivery in North America complemented by global capital markets expertise.

Cautionary Statements regarding Forward-Looking Statements and Other Matters

Forward-Looking Statements

All statements, other than statements of historical fact, contained or incorporated by reference in this press release constitute “forward-looking statements” and “forward-looking information” (collectively, “forward-looking statements”) within the meaning of applicable Canadian and United States securities legislation. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as “advancing”, “ahead”, “anticipated”, “assumptions”, “become”, “believes”, “commitment”, “conceptual”, “confidence”, “contemplated”, “continues”, “could”, “delivery”, “developer”, “emerging”, “estimates”, “exploration”, “eventual”, “expectation”, “feasibility”, “focused”, “future”, “generational”, “later”, “long-term”, “milestone”, “objectives”, “optimize”, “options”, “plan”, “positioned”, “potentially”, “pre-”, “projected”, “proposes”, “rights”, “risk”, “runway”, “scheduled”, “set to”, “strategy”, “studies”, “subject to”, “upside”, and “will”, or variations of such words, and similar such words, expressions or statements that certain actions, events or results can, could, may, should, would, will (or not) be achieved, occur, provide, result or support in the future, or which, by their nature, refer to future events. In some cases, forward-looking information may be stated in the present tense, such as in respect of current matters that may be continuing, or that may have a future impact or effect. Forward-looking statements include those relating to the completion (or close) of the Buy-downs (including the timing thereof and resulting reductions in either such NSR individually and/or in the aggregate) and the implications thereof (including impacts on the cash flows and other economics of the Cactus Project, and any upside for shareholders, related to such Buy-downs and/or any other prior royalty reductions or royalties vacated); the impacts of the Company’s royalty reduction strategy (including on Project economics), and any related strategic milestone; the impacts of the recently completed bought deal equity financing (including that such financing provides the necessary runway to advance the Cactus Project (including all Project-‑related workstreams) through Pre-Feasibility Study (or PFS) and then Definitive Feasibility Study to an eventual Final Investment Decision, potentially in Q4 2026, and any related confidence and clarity; any eventual Final Investment Decision (including timing thereof); ongoing and future workstreams (including those related to the PFS, and any permit amendments and Definitive Feasibility Study thereafter, or otherwise) and implications thereof (including positioning of the Cactus Project as to associated risk or ranking within Arizona or otherwise, and to deliver copper cathode production, with a projected industry-leading capital intensity); the risk of the Cactus Project; ongoing and future technical studies (including the current ongoing Pre-feasibility Study (or PFS) and any eventual Definitive Feasibility Study), moving forward with such study work (including related or other workstreams) and the timing, results or implications thereof (including any eventual Final Investment Decision); the results of the 2024 PEA (including risk, capital intensity, cash flow, net present value, or returns (including internal rate of return) and other economics, mine plan and production, and proposal of a generational open pit copper mine); the PFS and the Cactus Project contemplated thereby; project financing; the Company’s strategic and other objectives (including commitment to disciplined execution and long-term value creation for our shareholders, and the Cactus Project becoming a significant producer of copper cathodes in Arizona and the U.S.); and the future plans or prospects of the Company (including sustainability of the Cactus Project and becoming a mid-tier copper producer). Although the Company believes that such statements are reasonable, there can be no assurance that those forward-looking statements will prove to be correct, and any forward-looking statements by the Company are not guarantees of future actions, results or performance. Forward-looking statements are based on assumptions, estimates, expectations and opinions, which are considered reasonable and represent best judgment based on available facts, as of the date such statements are made. If such assumptions, estimates, expectations and opinions prove to be incorrect, actual and future results may be materially different than expressed or implied in the forward-looking statements. The assumptions, estimates, expectations and opinions referenced, contained or incorporated by reference in this press release which may prove to be incorrect include those set forth or referenced in this press release, as well as those stated in the Company’s prior press releases referenced herein (collectively, the “Referenced PRs”), the technical report for the Cactus Project filed on August 27, 2024 (the “2024 PEA Technical Report”), the Company’s Annual Information Form dated March 27, 2025 (the “AIF”), Management’s Discussion and Analysis (together with the accompanying financial statements) for the year ended December 31, 2024 and the quarter already ended in 2025 (collectively, the “2024-25 Financial Disclosure”) and the Company’s other applicable public disclosure (collectively, “Company Disclosure”), all available on the Company’s website at www.arizonasonoran.com and under its issuer profile at www.sedarplus.ca. Forward-looking statements are inherently subject to known and unknown risks, uncertainties, contingencies and other factors which may cause the actual results, performance or achievements of ASCU to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such risks, uncertainties, contingencies and other factors include, among others, the “Risk Factors” in the AIF, and the risks, uncertainties, contingencies and other factors identified in the Referenced PRs, the 2024 PEA Technical Report and the 2024-25 Financial Disclosure. The foregoing list of risks, uncertainties, contingencies and other factors is not exhaustive; readers should consult the more complete discussion of the Company’s business, financial condition and prospects that is provided in the AIF, the 2024-25 Financial Disclosure and other Company Disclosure. Although ASCU has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. Forward-looking statements contained herein are made as of the date of this press release (or as otherwise expressly specified) and ASCU disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by applicable securities laws. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from forward-looking statements. Accordingly, readers should not place undue reliance on forward-looking statements. The forward-looking statements referenced or contained in this press release are expressly qualified by these Cautionary Statements as well as the Cautionary Statements in the AIF, the Referenced PRs, the 2024 PEA Technical Report and the 2024-25 Financial Disclosure.

Preliminary Economic Assessments

The Preliminary Economic Assessment (or 2024 PEA) referenced in this press release and summarized in the 2024 PEA Technical Report is only a conceptual study of the potential viability of the Cactus Project and the economic and technical viability of the Cactus Project has not been demonstrated. The 2024 PEA is preliminary in nature and provides only an initial, high-level review of the Cactus Project’s potential and design options; there is no certainty that the 2024 PEA will be realized. For further detail on the Cactus Project and the 2024 PEA, including applicable technical notes and cautionary statements, please refer to the Company’s press release dated August 7, 2024 and the 2024 PEA Technical Report, both available on the Company’s website at www.arizonasonoran.com and under its issuer profile at www.sedarplus.ca.

Contacts

For more information

Alison Dwoskin, Director, Investor Relations

647-233-4348

adwoskin@arizonasonoran.com

George Ogilvie, President, CEO and Director

416-723-0458

gogilvie@arizonasonoran.com